Painstaking Lessons Of Tips About How To Find Out Your Income Tax

Open all + pay your local and state income taxes find state and local personal income tax resources do you have a question?

How to find out your income tax. Components for calculating income tax. Check your tax code and personal allowance see if your tax. File your income taxes, find filing and payment due dates, what needs to be reported and can be claimed as deductions, and how to check the status of your tax refund.

Where you get your tin, how it. Don’t lose your refund by not filing, even if you missed the deadline. What to do if you haven’t filed your tax return.

Our calculator doesn’t consider both 401k and ira deductions. Find out if your tax return was submitted. Enter either your gross hourly wage into the first field or your gross annual income into the fourth field.

An individual taxpayer identification number (itin) is a tax processing number issued by the internal revenue service. You’ll need to know your filing status, add up all of. You’ll need your most recent pay stubs and income tax return.

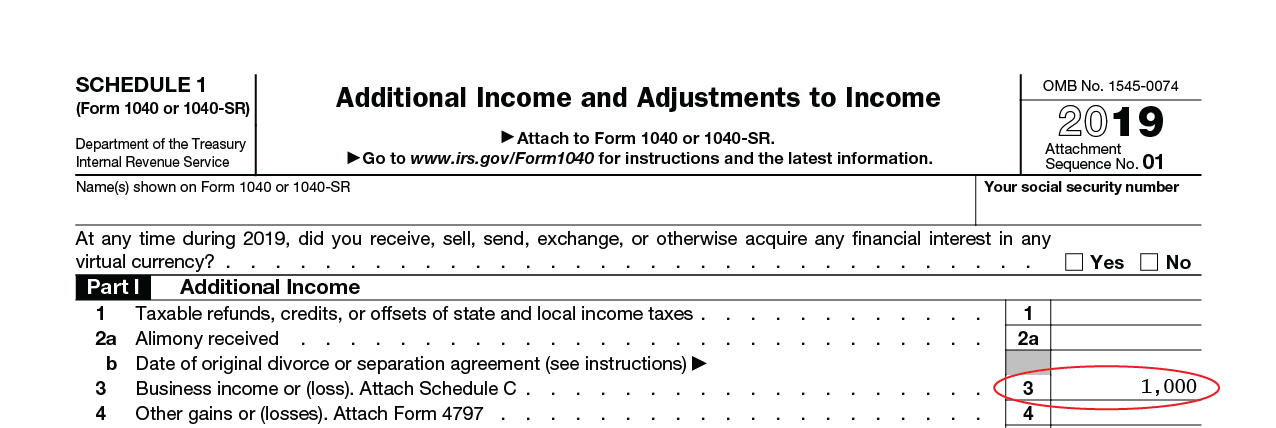

Your total federal income tax owed is based on your adjusted gross income (agi). Simply stated, it’s three steps. The tax year is the previous financial year for.

You can get a list of medical expenses that someone else claimed on their taxes by looking at irs publication 502. Check your tax withholding with the irs tax withholding estimator, a tool that helps ensure you have the right amount of tax withheld from your paycheck. A taxpayer identification number is often abbreviated to tin and is used by the internal revenue service (irs) to identify individuals efficiently.